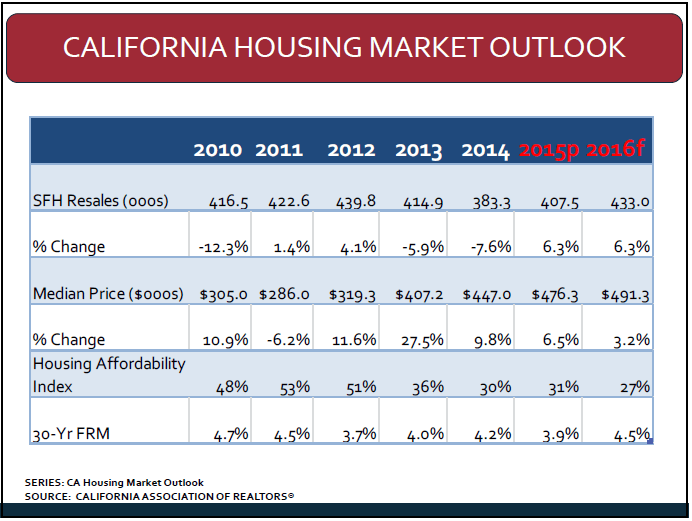

et’s talk about the market today. As you can tell from the table to the left, we’ve had some pretty great growth over the last handful of years! So if you bought property locally in 2011, the market’s timing was in your favor. In fact, if you purchased anytime in the last six years you’re sitting in a great position! But where are we headed? That’s the million dollar question, and the truth is, nobody knows for sure. The only thing we can do is to study the past and present and make our best educated guesses. Which is where I am currently sitting with a few of my properties within my portfolio today. They have appreciated along with the rest of the properties locally, and I am now looking at unrealized substantial equity gains that could be captured and re-purposed should I decide to sell them in today’s market. And so, the question I keep pondering is, “Are we near the top?”

Real Estate is on a continuous cycle. Its almost always moving up or down, just seems to do so at different speeds in different portions of its cycle. I’m sure most everyone remembers how fast it moved through 2002-2009. It moved very fast in both directions up, and then down! And although I say it moved fast, the reality is that it moved up for roughly five years, leveled off, and then down for roughly 3 years. So fast is a relative term here. But using the last cycle as a reference to the present cycle, we’ve had growth years from 2012-2016, five years. And from the table referenced above, the median home price seems to be appreciating at a slower percentage than previous years.